On October 28, 2016, the Electronic Coin Company released Zcash (ECC). Before changing its name, the ECC was known as Zerocoin Electric Coin Company, LLC. Zooko Wilcox-O’Hearn, a specialist in information security and cryptography, started the business. Together with academics from John Hopkins University, MIT, Tel Aviv University, and Technion, he created the Zcash protocol.

To create the first Zcash protocol, the ECC raised $3 million in funding. Zcash’s initial code base was inspired by Bitcoin. Additionally, Digicash, Mojo Nation, and the Tahoe Least-Authority File Store filesystem have all been associated with Zooko Wilcox-O’Hearn in the past. The BLAKE3 cryptographic hash function was also co-created by him.

Zcash produced a set of updates between 2016 and 2018 known as the “Sprout Series,” which included Overwinter and Sapling, two enhancements to the basic protocol. In March 2017, the Zcash Foundation was established with a 273,000 ZEC first endowment that had been issued from the “Founders Reward.” The Powers of Tau Ritual, the foundation’s largest multi-party computation ceremony, was organised.

Blossom, Zcash’s third network improvement, reduced the intended block interval to 75 seconds in December 2019. Heartwood and Canopy, the fourth and fifth network upgrades, were implemented in July and November of 2020, respectively. Zcash eliminated the “Founders Reward” and reduced miners’ incentives from 6.25 ZEC to 3.125 ZEC after the first halving in November 2020.

What is Zcash?

The decentralised blockchain-based cryptocurrency Zcash leverages advanced applied cryptography to enhance security and anonymity through shielded addresses. It was initially constructed using open-source software akin to Bitcoin.

The core goal of Zcash is anonymity, which is achieved by utilising zk-SNARKs, a particular kind of zero-knowledge proof technology that enables nodes on a blockchain network to validate transactions without disclosing users’ transaction details. Users cannot create or validate private transactions without a set of public parameters, which are required by the built-in function zk-SNARKs.

The complex secure multi-party computation known as a “Trusted Setup” on Zcash contains the public parameters. The need among internet users for a cryptocurrency with improved privacy characteristics is what gave rise to Zcash’s popularity.

To comply with audits and tax laws, Zcash users can also reveal transaction details, including addresses. The ticker sign for the Zcash digital asset token on trading markets is “ZEC.”

The “proof-of-work” SHA-256 hash mechanism protects the Zcash network. The algorithm is a part of the SHA-2 family, which is also utilised by Bitcoin. Zcash is traded on popular crypto exchanges like HitBTC, Binance, BKEX, CoinTiger, OKEx, Huobi Global, and FTX.

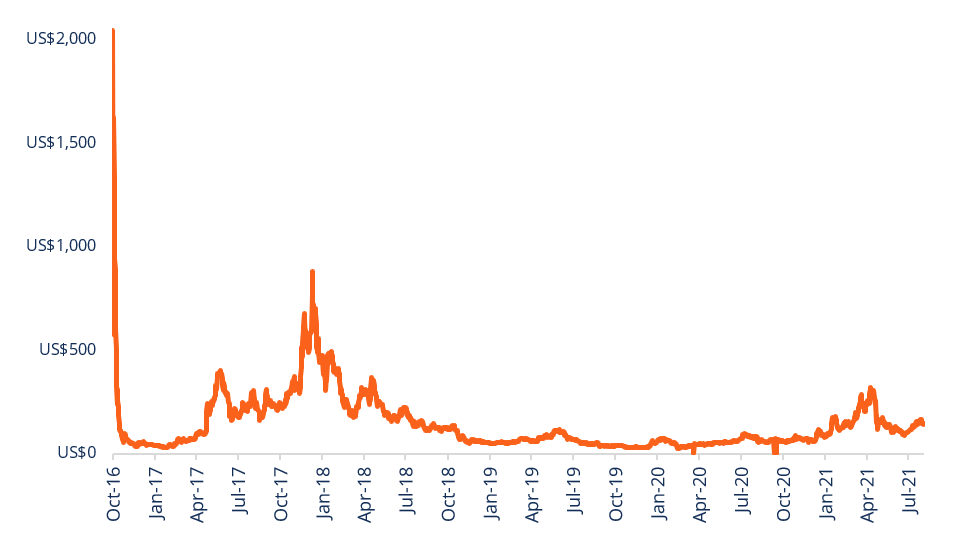

Zcash (ZEC-USD) Price Chart Since Inception

As of August 31, 2021, Zcash (ZEC) was priced at $143.72, with a market capitalization of $1.8 billion.

Zcash Trading

The “zatoshi,” or one hundred millionth of a ZEC, is the smallest ZEC unit and equals 0.00000001 ZEC. The Zcash blockchain contains a record of every Zcash transaction. On cryptocurrency exchanges, Zcash can be bought and held in Zcash wallets or any other regulated exchange wallet.

Similar to Bitcoin, there are only 21 million Zcash coins that can be mined. Zcash or ZEC’s price is solely influenced by changing macroeconomic conditions and the dynamics of the cryptocurrency market. As of August 2021, there were about 12.5 million Zcash in existence.

Zcash vs Bitcoin

The following are the primary variations between the two cryptocurrencies:

Instead of relying on Bitcoin, Zcash uses a built-in zk-SNARKs privacy protocol. Among others, privacy-focused cryptocurrencies like Verge, Horizen, Monero, and DASH are also available.

The majority of cryptocurrencies, including Bitcoin, are pseudonymous rather than anonymous and include addresses that can be used to determine the user’s identity. However, as Zcash transactions utilising zk-SNARKs are relayed through a private blockchain, the sender and receiver’s addresses and the amount of the transaction are not made public.

Zcash has a block time of 75 seconds as opposed to Bitcoin’s 10-minute block period.

Zcash Features

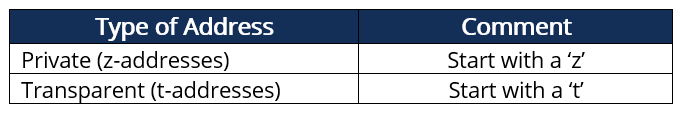

1. Addresses

The two types of Zcash addresses are:

Funds can be transferred between the two address types in any way since the two address types are compatible. Users must be conscious of each address’s potential privacy consequences. The majority of wallets and exchanges can support t-addresses, and some are updating to accommodate z-addresses.

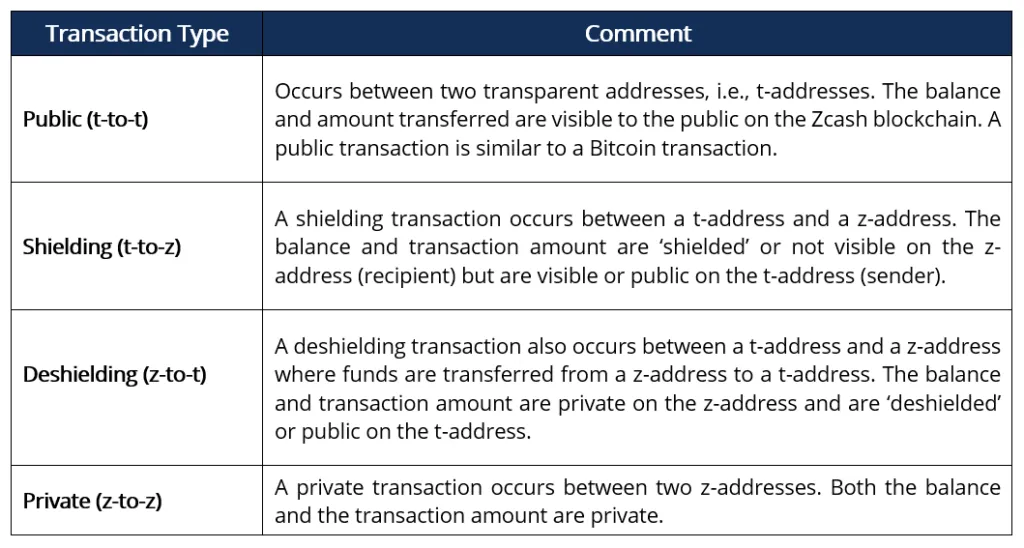

2. Transaction types

There are four main Zcash transaction types, as illustrated in the table below:

. Funding structure

ZECs are produced as “block rewards,” which means that as a new block is discovered and added to the blockchain, coins are produced and divided 80:20, or 80% into “miners’ reward” and 20% into “founders reward.”

The block reward is half (much like Bitcoin) every four years to reduce the rate of issuance as the ZEC cap gets closer to 21 million. Block rewards are still allocated in an 80:20 ratio, meaning that 80% of them go to miners and the remaining 20% is split between the Major Grants Fund (8%), ECC (7%), and Zcash Foundation (5%), even after the halving event that eliminated the founders’ reward in November 2020.

The block reward equals 3.125 ZEC as of the block reward halving in November 2020.

4. Viewing keys

Through a view key, which only permits read access, a z-address user can distribute transaction information. The disclosure is still under the user’s control. Such limited disclosure is permitted for tax, anti-money laundering, and auditing purposes.

5. Other supporting features

Encrypted messaging Transaction expiration is customizable and has a default low charge of 0.001 ZEC to reduce mempool bloat. 40 blocks are the standard expiry (or 50 minutes).

Although only currently accessible for public transactions, multi-signature transactions

How Zcash Is Mined

The Equihash hashing algorithm is used to define the tough mathematical problems that application-specific computers compete to answer in the proof-of-work cryptographic mining process. As compensation for their labour, the miners receive freshly produced coins.

Prior to the most recent improvements, only GPUs could mine Zcash coins. More ASIC hardware has been put on the Zcash Network after the Antminer Z9 mini’s debut in June 2018, resulting in an increase in growth of over 10 times.

1. Profitability calculation

Zcash mining profitability is determined by calculating revenues, costs, and capital expenditure.

Revenue: Crypto-mining calculators that are available to the general public can be used to determine current profitability. The daily revenue generated by 1Msol of hash power needs to be calculated. Preferably, a forecast of revenue changes should be made over a 1- to 3-year investment horizon. A decline in revenue owing to network difficulty, the price of Zcash, the hash rate, and anticipated changes to miners’ block rewards are additional variables to be predicted.

Operating costs: The cost of electricity for the miner and mining pool fees are used to calculate operating costs. Therefore, it is essential to power equipment using inexpensive electricity. Renewable energy is being tested by other miners.

Capital investment: Miners must purchase modern, reliable, and productive equipment that maximises power utilisation while providing high throughput.

Therefore, miners can provide significant long-term risk-adjusted returns by utilising effective machinery, inexpensive power utilisation, and other factors.

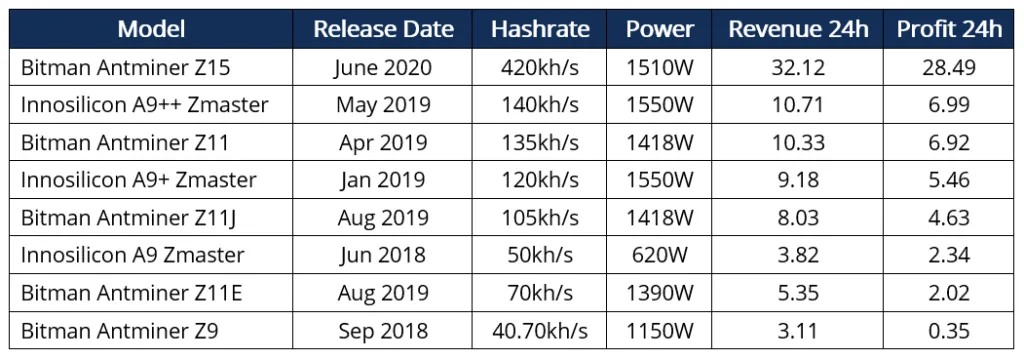

2. Purchasing mining hardware and hosting

Zcash could previously be mined on CPU and GPU hardware. ASIC machines, which are more productive, have become the hardware of choice for crypto mining for specialised miners and mining pools as a result of developments in mining technology.

Application-Specific Integrated Circuits are known as ASICs. Compared to the previous generation of CPUs and GPUs, they are more efficient and offer superior Zcash mining customization options.

The Equihash ASIC miners listed below are offered for sale. Some, though, can become outdated, so exercising caution while buying is crucial.

ASIC machines can be hosted in a mining hosting facility or at home. The disadvantages of hosting ASICs at home include their high electricity consumption, which can harm electrical wiring and fuses, and the loud noise they make when operating.

Mining hosting sites can take care of setup expenses, electricity accessibility, and continuous maintenance for a hosting charge. Among others, well-known mining hosting websites include Core Scientific, Skychain Technology, and Optimum Mining Host.

By connecting through a PSU and then to a cable using a regular network cable, the ASIC machine may be started up. Users should use a scanning programme to find the machine’s IP address, such as AngryIP or Locator. A dashboard will appear after entering the IP address into a web browser’s URL, allowing mining to begin.

3. Join a mining pool

It is suggested that you join a mining pool rather than mining independently. Mining pools provide a more reliable income stream based on the hash rate contributed.

Before participating, it is important to consider the pool’s size, payout options, location, statistics, customer support, pool price, user interface, and ping times to the server. The pools with the best payout percentages and user interfaces are the best ones to select. The leading Zcash mining pools include F2pool, Antpool, Poolin, Viabtc, Flypool, Slushpool, and Luxor.

4. Setting up a Zcash wallet

Setting up a Zcash wallet and a Zcash address to receive payouts is the last step. For increased secrecy, it’s crucial to select a Zcash protected address while receiving payouts. Users should check that the mining pool accepts addresses with shields, nevertheless.

Advantages and Criticism of Using Zcash

The following are Zcash’s main benefits:

transactions at a discount

Metadata about users’ transactions are anonymous.

selective sharing of payment information with a third party

expiry of a transaction

Transactions with multiple signers

The main issue with Zcash is that it could be utilised by cybercriminals as a safe haven for illicit transactions (especially on the dark web). Zcash countered that there are a number of valid uses for the cryptocurrency, including the anonymous drug purchases made by people with chronic medical conditions, businesses shielding their trade secrets or supply chain information from rivals, and other privacy-related uses.

Future Developments

The founder of Zcash, Wilcox-O’Hearn, recently argued that Zcash should switch from the energy-intensive “proof-of-work” mechanism to a more environmentally friendly “proof-of-stake” method. Nodes on the network that support “proof-of-stake” can post holdings as collateral that could be forfeited if they behave dishonourably.

According to Wilcox-O’Hearn, “proof-of-stake” is more lightweight, swifter, and secure while also being less expensive. The carbon footprint of cryptocurrencies may be significantly decreased. Wilcox recently claimed that “proof-of-stake” is already “proved” and that the successful launches of Algorand, Cardano, Tezos, and other cryptocurrencies are evidence of this

More Resources

We appreciate you reading the Zcash guide from CFI. The following extra CFI resources will help you advance your career:

Cryptocurrency Mining for Bitcoin

Dogecoin\sEthereum